Trade Like a Stock Market Wizard by Mark Minervini

The best balance of preachy and practical: Strategy that actually works.

I'd seen this book all over Finwit, and since I'm into trading AND books, there was no reason for me not to read it.

And I'm so grateful. Having tried and tested the strategies myself, I can attest to their usefulness.

This book provides a solid foundation and clarity to help you get started in trading. And if you are already a pro, Mark packs a punch between the pages to help you refine your trading methods. A helpful manual for anyone who is serious about trading. A brief summary of my takeaways.

Mindset Takeaways:

Build confidence:

If Mark can do it, so can you. Nobody but you will make you wealthy.

If you've ever traded, you've likely experienced self-sabotage. As he says in the book, optimists and pessimists are both correct. It is entirely up to you to decide which you will be.

Hobbies do not pay; rather, they cost you:

Learn to trade using a live account. Paper trading does not replicate real-time emotions and only breeds unfounded arrogance.

Do not trade like a fund manager:

You have the liquidity that they do not. You can make moves without significantly affecting the stock price, which a fund manager with a large corpus cannot do. Balance sheet analysis is not the holy grail of investing. Models do not always work, or accountants would be making money all the time.

Stop questioning momentum:

Your job is to follow it and profit from it. Take the stop loss or ride the momentum. There will be another chance to re-enter the market without emotions. If you cannot learn to accept small losses, you will eventually suffer large losses. It is unavoidable. Learn how to lose as little money as possible when you make a mistake.

Smart people learn from mistakes. Really smart people learn from others’ mistakes.

Pockets change, stocks change, but Wallstreet never changes because human nature never changes.

Technical Takeaways:

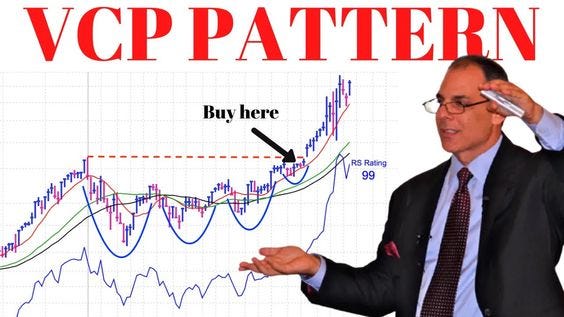

Consolidating, Accumulating, Distribution, and Capitulation are the four stages of stock price maturation. Mark Minervini uses the Volatility Contraction Pattern (VCP), Strategic Entry Point Analysis (SEPA), and fundamental indicators to trade these stages. Stocks move due to anticipation and surprise. These can be predicted by looking at the following factors:

Look for scalable growth:

A company gaining market share in a thriving industry.

The company's products and services are in high demand.

The company's products and services have a very large market.

A healthy balance sheet, expanding margins, a high return on capital, reasonable debt, and so on are all indicators of good management.

Bullish indicators:

Earnings surprise, accelerating earnings per share, expanding margins, and EPS breakout. According to the cockroach effect, one good quarter means more are on the way. Earnings surprises have a lingering effect.

Inventory control:

If finished goods rise faster than raw materials or work in progress, the product is piling up. It is a bad sign because sales are not happening as expected or because management misjudged future demand.

Trading during a recession:

As the bear market approaches its bottom, the leading stocks, those that have best resisted the decline, will emerge first and then sprint ahead. Look for stocks that will outperform the market in terms of strength, speed of recovery, and percentage gain. The stock that emerges first with the most power in the early stages of a new bull market is usually the best candidate for super performers.

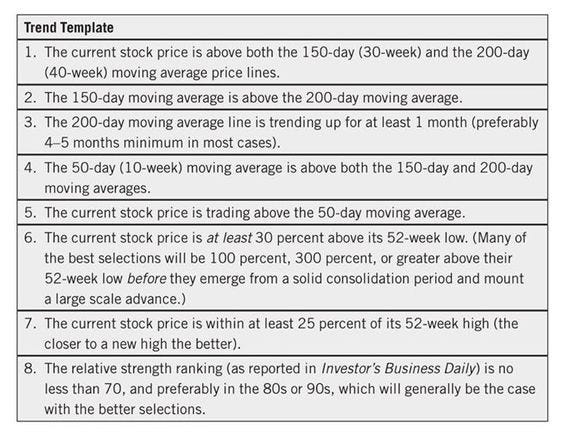

The Trend design:

This is the infamous screener that Minervini uses to shortlist stocks for his research. Type it into the search box of any good screener platform and try it for yourself!

Hope you find this helpful. And if you do decide to pick up the book, do use my affiliate link!